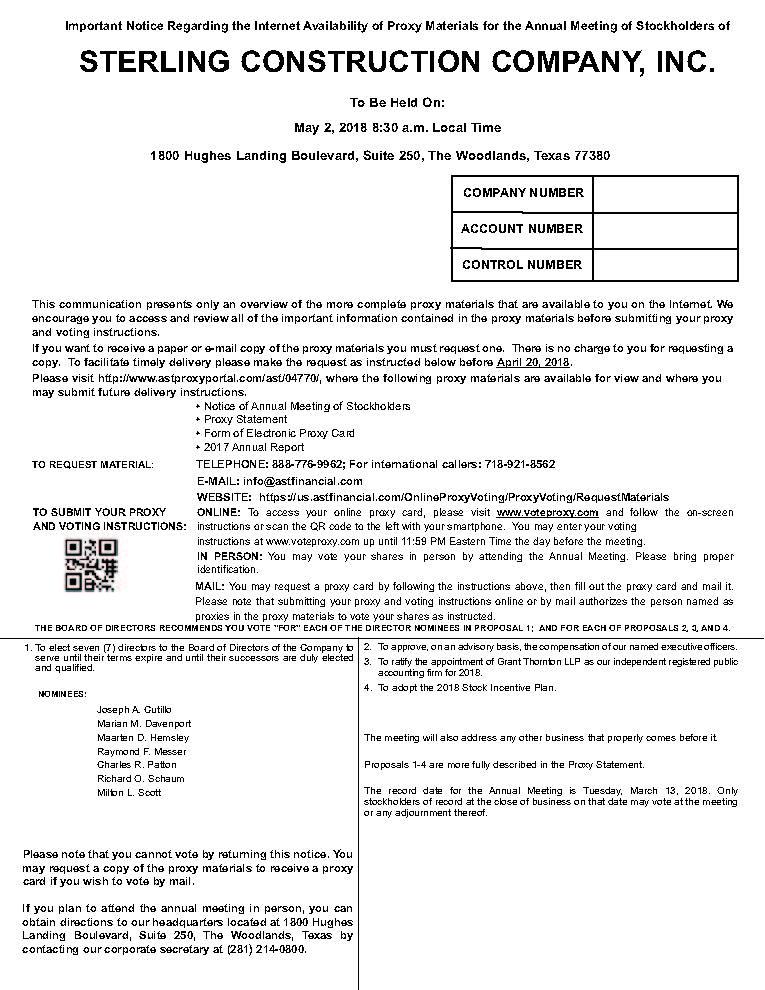

| Time: | | 8:30 a.m., local time | | | | Place: | | 1800 Hughes Landing Boulevard The Woodlands, Texas 77380

|

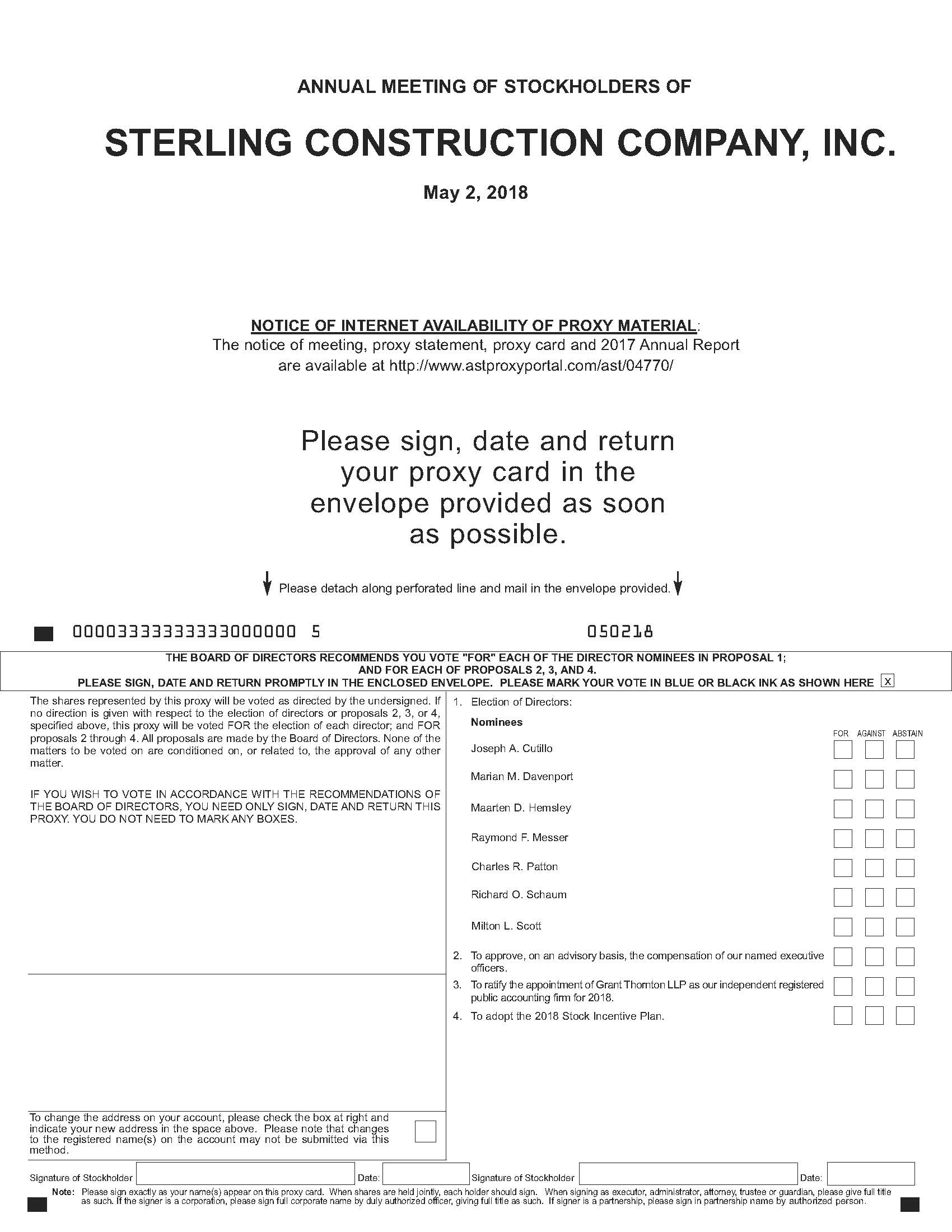

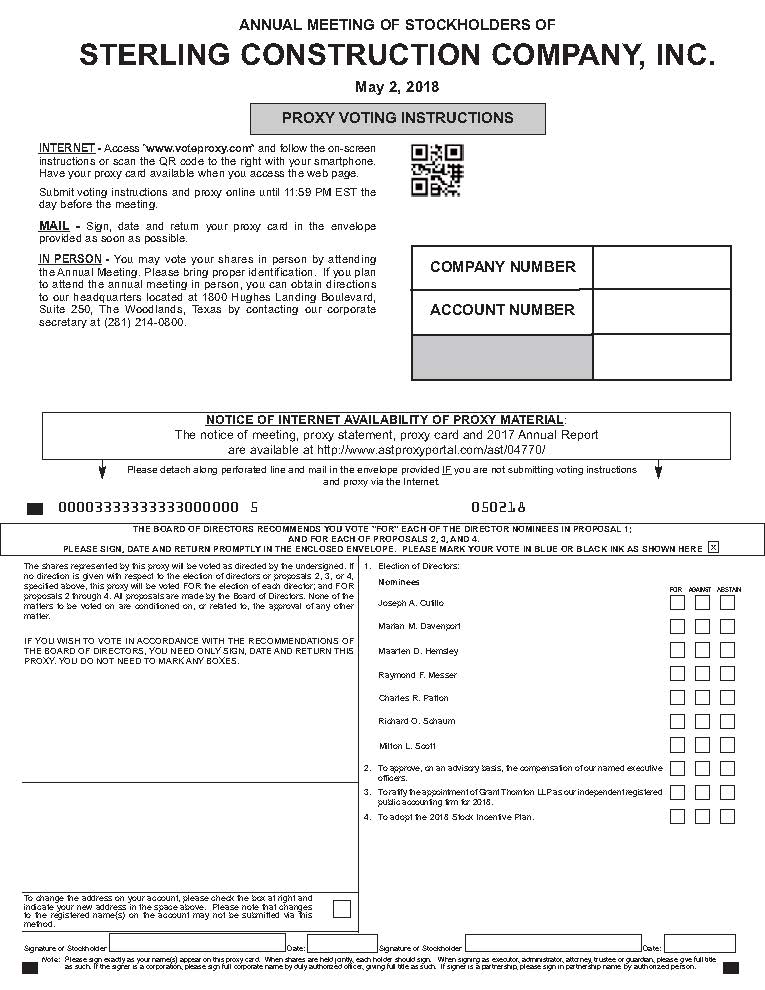

Purpose: • To elect the seven director nominees named in the accompanying proxy statement;

To approve, on an advisory basis, the compensation of our named executive officers;

To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for 2018;

To adopt the 2018 stock incentive plan; and

To transact such other business as may properly come before the annual meeting.

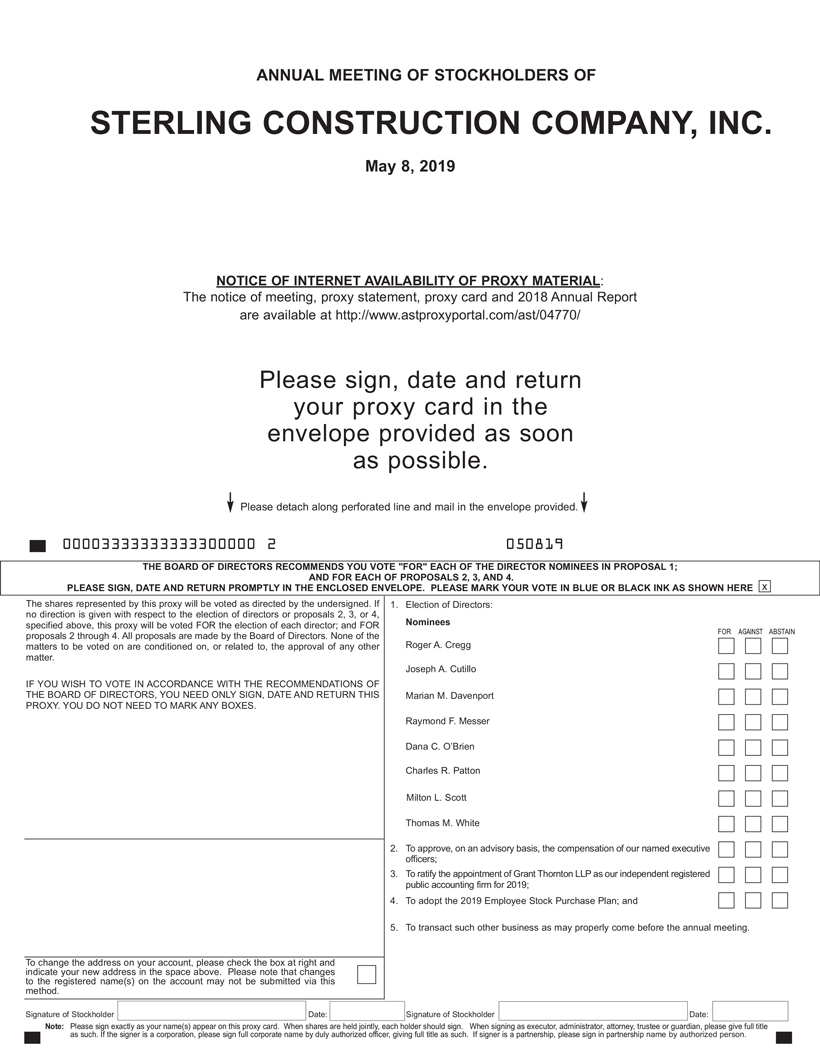

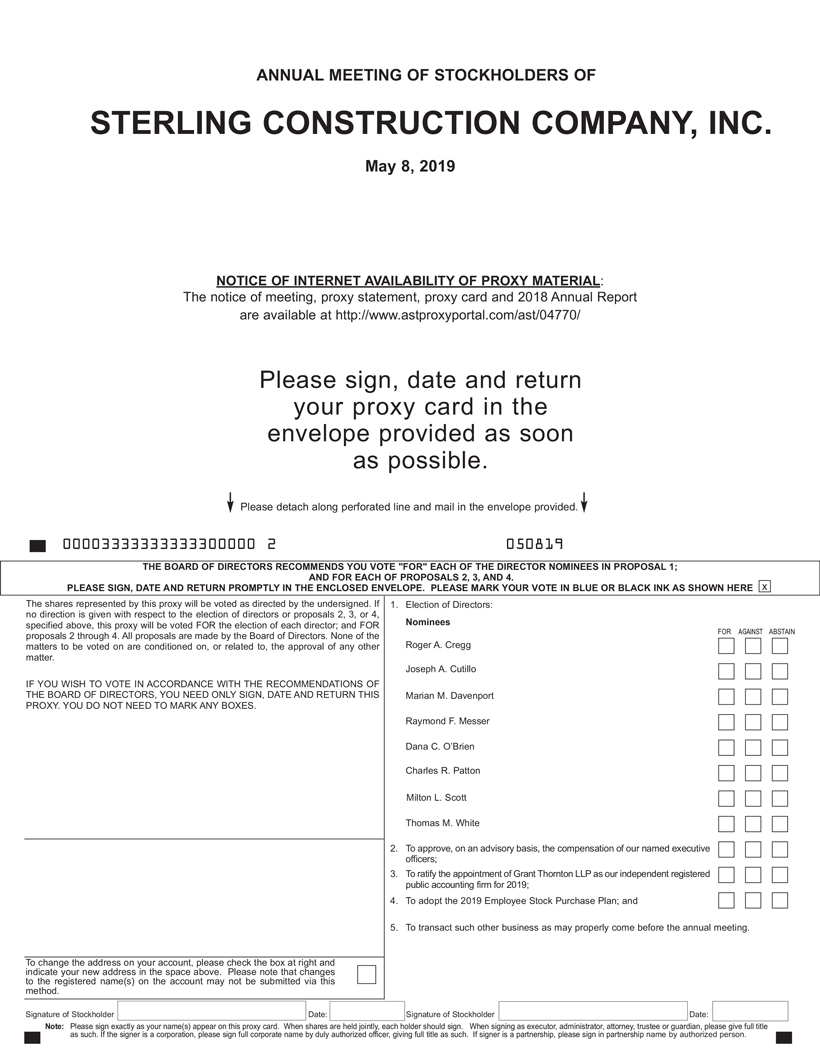

| | | Purpose: | | (1) To elect the eight director nominees named in the accompanying proxy statement; | | | | | (2) To approve, on an advisory basis, the compensation of our named executive officers; | | | | | (3) To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for 2019; | | | | | (4) To adopt the 2019 Employee Stock Purchase Plan; and | | | | | (5) To transact such other business as may properly come before the annual meeting. | | | | Record Date: | | Only stockholders of record as of the close of business on March 13, 201819, 2019 are entitled to notice ofnoticeof and to attend or vote at the annual meeting. |

| | | Proxy Voting: | | It is important that your shares be represented at the annual meeting whether or not you are personally able to attend. Accordingly, after reading the accompanying proxy statement, please promptly submit your proxy and voting instructions via internet or mail as described on the proxy card. |

By Order of the Board of Directors.

Richard E. Chandler, Jr.

Executive Vice President,

General Counsel & Secretary

March 20, 2018

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON May 2, 2018.

This proxy statement and the company’s 2017 annual report to stockholders are available at

http://www.astproxyportal/com/ast/04770

Table of Contents

| | | | | By Order of the Board of Directors. | | |  | | | Richard E. Chandler, Jr. | | | Executive Vice President, | | | General Counsel & Secretary | | | | Page | March 26, 2019 |

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 8, 2019. This proxy statement and the Company’s 2018 annual report to stockholders are available at http://www.astproxyportal.com/ast/04770/ |

Table of Contents Sterling Construction |2019 Proxy Statement |i |

|Sterling Construction Company, Inc. |

1800 Hughes Landing Boulevard Suite 250

The Woodlands, Texas 77380

2019 Proxy Statement

This summary highlights selected information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.submitting voting instructions for your shares. For more information regarding our 20172018 financial and operational performance, please review our 20172018 annual report to stockholders (2017(“2018 annual report)report”). The 20172018 annual report, including financial statements, is first being made available to stockholders together with this proxy statement and form of proxy on or about March 20, 2018. 20182019 Annual Meeting of Stockholders

Time and Date:8:30 a.m., local time, Wednesday, May 2, 2018

| | | Time and Date: | | 8:30 a.m., local time, Wednesday, May 8, 2019 | | | | Place: | | 1800 Hughes Landing Boulevard The Woodlands, Texas 77380 |

Record Date:March 13, 2018

Voting:Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to

one vote for each director position and one vote for each of the other proposals to be voted on at the annual meeting.

Agenda and Voting Recommendations

| | | | | | | | | Item | | Description | | Board Vote Recommendation | | Page | | 1 | | Election of seven director nominees | | FOR each nominee | | | | 2 | | Advisory vote to approve the compensation of our named executive officers | | FOR | | | | 3 | | Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for 2018 | | FOR | | | | 4 | | Adoption of the 2018 stock incentive plan | | FOR | | |

| | | Director HighlightsRecord Date: | |

| | | | | | | | | | | | | Name | | Age | | Director Since | | Principal Occupation | | Independent | | Board Committees | | Joseph A. Cutillo | | 52 | | 2017 | | Chief Executive Officer of Sterling Construction Company, Inc. | | No | | None | | Marian M. Davenport | | 64 | | 2014 | | Executive Director of Genesys Works – Houston | | Yes | | Compensation Corporate Governance and Nominating*

| | Maarten D. Hemsley | | 68 | | 1998 | | Founder, Chairman and President of New England Center for Arts & Technology, Inc. | | Yes | | Audit Corporate Governance and Nominating

| | Raymond F. Messer | | 70 | | 2017 | | Chairman Emeritus of Walter P Moore | | Yes | | Audit Compensation

| | Charles R. Patton | | 58 | | 2013 | | Executive Vice President — External Affairs American Electric Power Company, Inc. | | Yes | | Compensation

| | Richard O. Schaum | | 71 | | 2010 | | General Manager, 3rd Horizon Associates LLC | | Yes | | Audit Compensation*

| | Milton L. Scott** | | 61 | | 2005 | | Chairman and Chief Executive Officer of the Tagos Group, LLC | | Yes | | Audit* Corporate Governance and Nominating | | | | | | | | | | | | |

* Committee Chairman

** Board Chairman

| March 19, 2019 | | | 2017 Performance HighlightsVoting: | (page 22)

| Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director position and one vote for each of the other proposals to be voted on at the annual meeting. |

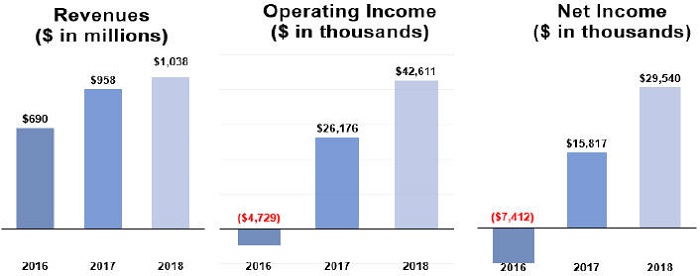

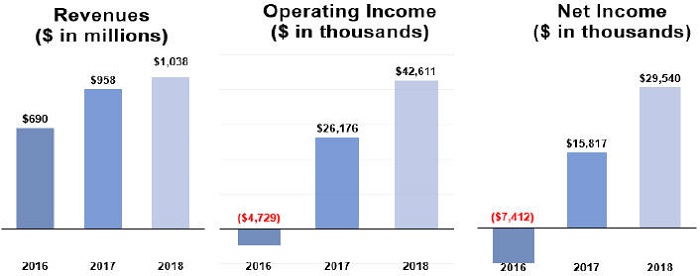

Revenues increased 38.8%, from $690.1 million in 2016 to $958.0 million in 2017

Operating income for 2017 was $26.2 million, compared to an operating loss of $4.7 million in 2016

Gross margins increased by 52.5%, from 6.1% in 2016 to 9.3% in 2017

Stock price growth of 92%, from $8.46 per share at year end 2016 to $16.28 per share at year end 2017

Diluted net earnings per share attributable to common stockholders for 2017 was $0.43, compared to a net loss per share of $0.40 for 2016

Completed the transformative acquisition of Tealstone Residential Concrete, Inc.Agenda and Tealstone Commercial, Inc.Voting Recommendations | | | | | | | | | Item | | Description | | Board Vote Recommendation | | Page | | | | | | | | 1 | | Election of eight director nominees | | FOR each nominee | | 14 | | | | | | | | 2 | | Advisory vote to approve the compensation of our named executive officers | | FOR | | 37 | | | | | | | | 3 | | Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for 2019 | | FOR | | 40 | | | | | | | | 4 | | Adoption of the 2019 Employee Stock Purchase Plan | | FOR | | 41 | | |

Secured new $85 million credit facility

Relisted on the Russell 3000

| | | Executive Compensation Highlights | |

Awards under our annual incentive program are based on Corporate Governance Highlightsachievement of performance metrics.

Annual awards tied to continued service, as 50% of annual incentive awards are paid in shares of restricted stock units vesting over three years.

Clawback policy applicable to incentive awards.

Anti-hedging and anti-pledging policies applicable to our executive officers.

Retention of an independent compensation consultant as necessary.

Stock ownership guidelines applicable to executive officers.

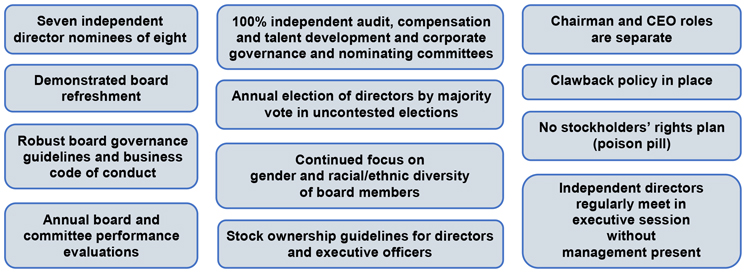

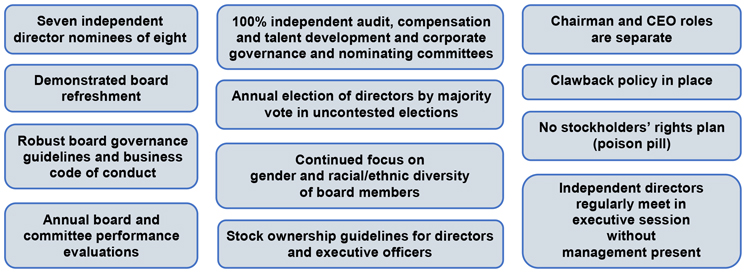

| | | Corporate Governance Highlights | |

We are committed to strong and effective governance practices that promote and protect the interests of our stockholders. Our commitment to good corporate governance is illustrated by the following practices:highlights:

Sterling Construction |2019 Proxy Statement |1 |

•Director Nominees Overview

| | | | | | | | | | | | | | Name | | Age | | Director Since | | Independent | | Principal Occupation | Roger A. Cregg | | 62 | | N/A | | ✓ | | Director of Comerica Incorporated | Joseph A. Cutillo | | 53 | | 2017 | | X | | Chief Executive Officer of Sterling Construction Company, Inc. | Marian M. Davenport | | 65 | | 2014 | | ✓ | | Director of Genesys Works – Houston | Raymond F. Messer | | 71 | | 2017 | | ✓ | | Chairman Emeritus of Walter P Moore | Dana C. O’Brien | | 51 | | 2019 | | ✓ | | Senior Vice President and General Counsel of CenterPoint Energy(*) | Charles R. Patton | | 59 | | 2013 | | ✓ | | Executive Vice President — External Affairs of American Electric Power Company, Inc. | Milton L. Scott | | 62 | | 2005 | | ✓ | | Chairman of the Board of Sterling Construction Company, Inc. & Chairman of the Board of Directors and Chief Executive Officer of Tagos Group, LLC | Thomas M. White | | 61 | | 2018 | | ✓ | | Executive Chairman of Cardinal Logistics Management Corporation |

| (*) | As publicly-announced, effective April 2, 2019, Ms. O’Brien will resign from her positions with CenterPoint Energy and will join The Brinks Company (NYSE: BCO) as Senior Vice President and General Counsel effective April 15, 2019. |

|Board independence2 | (allSterling Construction |2019 Proxy Statement

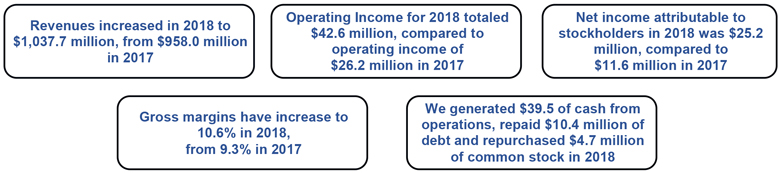

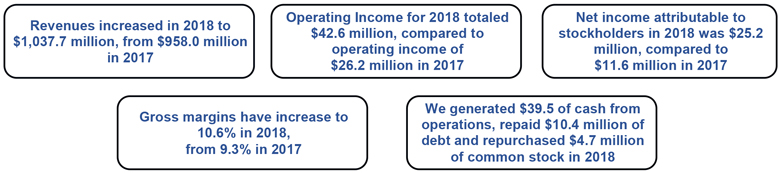

2018 Performance Highlights

The financial improvements reflect progress in delivering our multi-year strategy to solidify the base, grow high margin products and expand into adjacent markets. Our strategic element to solidify the base of the heavy civil construction business focuses on cost reductions, remaining disciplined at the bid table, monitoring pricing at the time of bid, and executing the projects to expectations. The strategy element to grow high margin products is reflected in the increasing percentage of backlog ofnon-heavy highway projects. Finally, expansion of the residential business, as well as other acquisition opportunities will lead to further expansion into adjacent markets. Overall, the execution of our non-employee director nomineesstrategy led to improved operating income of $42.6 million in 2018 compared to operating income of $26.2 million in 2017. Executive Compensation Highlights During the last few years, we have made several key enhancements to our executive compensation programs:

We are independent, which is 6 out of our 7 director nominees).

•100% independent audit,committed to developing and maintaining executive compensation and corporate governance and nominating committees.

•The roles of Chairman and Chief Executive Officer are separate.

•Directors elected annually.

•Directors in an uncontested election are elected by a majority vote.

•No stockholders rights plan (poison pill).

•Stock ownership guidelines for directors and executive officers.

•Annualpractices that enhance the performance evaluations of the board overseen by the corporate governanceCompany and long-term value for its stockholders. | | | | | | | | | | What WeDo: | | | | What WeDon’t Do: | | | | | | | ✓ | | Executive Incentive Program contains both short term and long term incentive awards. | | | | X | | No TaxGross-Ups: We do not provide any tax gross ups to our executive officers. | | | | | | | ✓ | | Executive Incentive Program Awards based on performance: Awards under our executive incentive programs are based on the achievement of specific performance metrics. | | | | X | | Anti-Hedging Policy: We prohibit our executive officers from entering into hedging arrangements with respect to our securities. | | | | | | | ✓ | | Retention of Independent Compensation Consultant as Necessary. | | | | X | | Anti-Pledging Policy: We prohibit our executive officers from pledging our securities. | | | | | | | ✓ | | Stock Ownership Guidelines applicable to executive officers. | | | | X | | No Guaranteed Bonuses: We do not guarantee bonus payments to our executive officers. | | | | | | | ✓ | | Clawback Policy: The Company has a clawback policy applicable to awards under our cash and equity incentive programs. | | | | X | | No Credit for Unvested Performance Shares under our stock ownership guidelines applicable to executive officers. |

Sterling Construction |2019 Proxy Statement |3 |

nominating committee.

•Independent directors regularly meet in executive sessions without management present.

•Robust board governance guidelines and code of business conduct.

•Continued focus on board diversity.

Corporate Governance Board Governance Guidelines; Ethics and Business Conduct Policy We are committed to strong and effective governance practices that promote and protect the interests of our stockholders. Our board governance guidelines, along with the charters of the standing committees of our board, provide the framework for the governance of the companyCompany and reflect the board’s commitment to monitor the effectiveness of policy and decision making at both the board and management levels. Our board governance guidelines and our code of business conduct are available atwww.strlco.com under Investor Relations–Corporate Governance.Relations-Board Governance and –Code of Business Conduct, respectively. Both are available in print to any stockholder who requests a copy. Amendments to or waivers of our code of business conduct granted to any of our directors or executive officers will be published promptly on our website. Such information will remain on our website for at least 12 months. Board Composition and Leadership Structure Our board has the primary responsibility of oversight of the management of our business and affairs. Our current board of directors consists of seveneight members, sixseven of whom have been determined by our board to be independent, specifically Ms. Davenport and Messrs. Hemsley, Messer, Patton, Schaum and Scott.independent. Mr. Cutillo, our chief executive officer, is our onlynon-independent director. Our board of directors recognizes the importance of having a strong independent board leadership structure to ensure accountability and to provide effective oversight of management. Milton L. Scott serves as our chairman of the board of directors with responsibilities that include: (1) presiding at meetings of the board and executive sessions of its independent directors; (2) presiding at the annual meeting of stockholders; (2)(3) serving as a liaison between the independent directors and senior management; and (3)(4) approving the agendas for board meetings.meetings; and (5) calling meetings of the independent directors. The board of directors believes that the separation of the roles of chairman and chief executive officer, as required by our board governance guidelines, continues to be the appropriate leadership structure for the companyCompany at this time. The board believes this structure provides an effective balance between strong company leadership and appropriate safeguards and oversight by independent directors. Board and Committee Independence; Financial Experts On the basis of information solicited from each director, and upon the advice and recommendation of the corporate governance and nominating committee, our board of directors annually determines the independence of each of our then-current directors in connection with the nomination process. Further, in connection with the appointment of any new director to the board during the year, our board of directors makes the same determination. In making these determinations, our board, with assistance from the Company’s legal counsel, evaluated responses to a questionnaire completed annually by each director regarding relationships and possible conflicts of interest between each director, the Company and management. In its review of director independence, our board and legal counsel considered all commercial, industrial, banking, consulting, legal, accounting, charitable, and familial relationships any director may have with the Company or management. Our board of directors has determined that each of our director nominees (other than Mr. Cutillo) has no material relationship with the Company and is independent as defined in the director independence standards of NASDAQ listing standards, as currently in effect. Further, our board of directors has determined that each of the members of the audit, compensation and talent development and corporate governance and nominating committees has no material relationship with the Company and satisfies the independence criteria (including the enhanced criteria with respect to members of the audit and compensation and talent development committees) set forth in the applicable NASDAQ listing standards and SEC rules. In addition, our board of directors has determined that each of Messrs. Scott and White qualifies as an “audit committee financial expert,” as such term is defined by the rules of the SEC. Director Nominees Experience and Skills Matrix The following table notes the breadth and variety of experience and skills that each of our director nominees brings to the Company and which enable the board to provide insightful leadership to the Company to advance its strategies: |4 | Sterling Construction |2019 Proxy Statement

| | | | | Director Nominees Experience and Skills Matrix | CEO or other Senior Executive Experience | | Experience in senior leadership positions provides our board with practical insights in developing and implementing business strategies, maintaining effective operations and driving growth, so that we may achieve our strategic goals. | | 8 of 8

director

nominees | Construction Industry Experience | | Industry expertise and experience in construction allows the board to develop a deeper understanding of our key business, its operations and key performance indicators in a competitive environment. | | 3 of 8

director

nominees | Financial, Accounting or Financial Reporting | | Experience as an accountant, auditor, financial expert or other relevant experience is critical to allowing the board to oversee the preparation and audit of our financial statements and comply with various regulatory requirements and standards. | | 5 of 8

director

nominees | Other Public Company Board Experience | | Directors who serve or have served on the boards of other public companies understand the responsibilities of a public company and board and can provide insight on issues commonly faced by public companies gained from this experience. | | 4 of 8

director

nominees | Capital Markets & Banking Experience | | Experience overseeing investments and capital market transactions provides the board with critical background, knowledge and skills that enhance the Company’s ability to raise capital to fund its business. | | 3 of 8

director

nominees | Legal & Regulatory Compliance Experience | | Experience in the legal field or in regulated industries provides the board with knowledge and insights in complying with government regulations and legal obligations, as well as identifying and mitigating legal and compliance risks. | | 4 of 8

director

nominees | Human Resource Management | | Experience in human resources and executive compensation helps the board and the Company identify, recruit, retain and develop key talent and to grow diversity of personnel at all levels throughout the Company. | | 6 of 8

director

nominees | Risk Management & Oversight | | Experience overseeing complex risk management allows the board to pre-emptively identify, assess and mitigate key risks and to design and implement risk management practices to protect shareholder value. | | 3 of 8

director

nominees | Corporate Strategy & Business Development | | Corporate strategy and business development experience enhances the board’s ability to develop innovative solutions, including our business and strategic plans, and to drive growth in our competitive industry. | | 8 of 8

director

nominees | Corporate Governance & Ethics | | Directors with experience implementing governance structures and policies provide an understanding of best practices and key issues, enhancing our ability to maintain good governance and to execute new key governance initiatives. | | 6 of 8

director

nominees | | Independence | | Directors who are “independent” under the rules of the SEC, listing exchanges and other entities allow the board to provide unbiased oversight over the Company and to implement governance practices with integrity and transparency. | | 7 of 8

director

nominees |

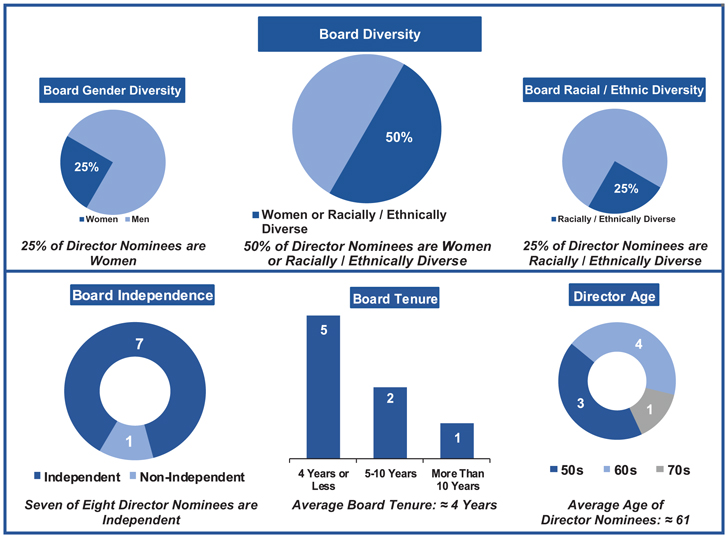

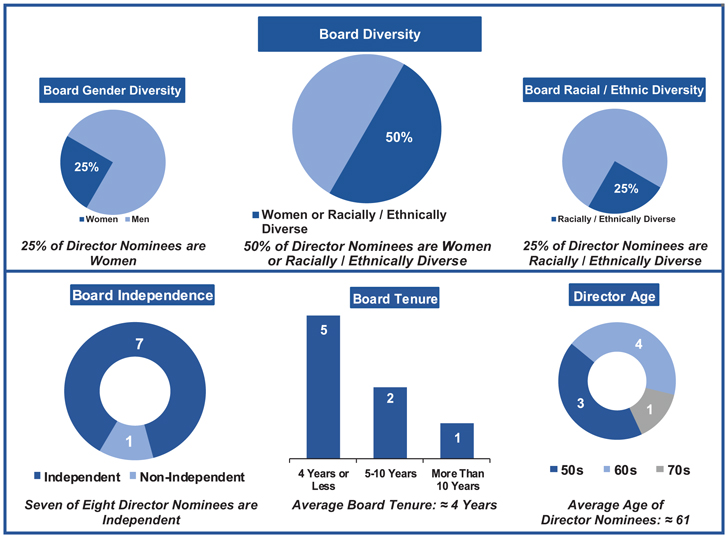

Board Diversity, Tenure and Refreshment We believe the Company’s director recruitment and nominations process demonstrates its continued focus on gender and racial diversity, as well as helps to ensure a diversity of skills, experience and tenure on our board, which further promotes and supports the Company’s long-term strategic goals. Board Diversity Although we do not have a formal diversity policy, we continue to focus on diversity as an important factor in determining the composition andmake-up of the board and board diversity is a consideration in making nominee recommendations and filling board vacancies. During the recruitment and evaluation of the suitability of current directors and potential director-nominees, the corporate governance and nominating committee considers the diversity of directors and nominees as one consideration among many. To achieve diversity among directors, the corporate governance and nominating committee considers a number of demographics, including, but not limited to, race, gender, ethnicity, culture, nationality and age to continue developing a board that reflects diverse backgrounds, viewpoints, experience, skills and expertise. The addition of new directors over the past two years (as discussed in more detail below under “—Board Tenure and Refreshment”) has increased the diversity of our board, including the gender, experience and skills diversity of our board. Sterling Construction |2019 Proxy Statement |5 |

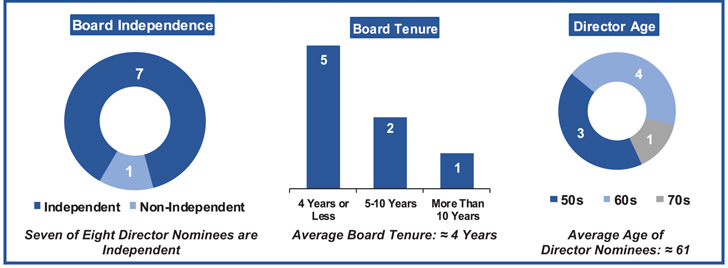

Board Tenure and Refreshment Since 2017, we have added four new directors, all of whom are standing for reelection at the meeting. Specifically, we have added two independent directors to our board since our last annual meeting of stockholders. On July 31, 2018, the board appointed Thomas M. White to serve as a director effective immediately. On December 12, 2018, the board appointed Dana C. O’Brien to serve as a director effective January 1, 2019. In addition, at this year’s annual meeting of stockholders, we have included Roger A. Cregg as a director nominee. If elected to the board, Mr. Cregg will bring experience in residential housing construction, as well as other additive skills to the board, including but not limited to, financial and accounting expertise, and public company executive management and leadership experience. The average tenure of our director nominees is approximately 4 years and the average age is approximately 61. As part of its board recruitment and refreshment process, the board will continue to seek to appoint new directors who complement the diversity, skills and expertise of the board. As mentioned above, gender and racial/ethnic diversity will remain an important factor for the board in its director recruitment and refreshment efforts.

Board and Committee Meeting Attendance Our board of directors held a total of nineseven meetings during 2017.2018. During 2017,2018, each director participated in more than 75% or more of the total number of meetings of our board and meetings of each committee on which such director served. Messrs. Cutillo and Messer did not joinMr. White joined our board of directors until April of 2017. effective July 2018 and Ms. O’Brien joined our board effective January 2019.We expect our directors to attend the annual meetings of our stockholders. Our company policy is to schedule a regular meeting of the board of directors on the same day as the annual meeting of stockholders so that directors can attend the annual meeting without the companyCompany incurring the extra travel and related expenses of a separate meeting. All of our directors attended our 20172018 annual meeting of stockholders. |6 | Sterling Construction |2019 Proxy Statement

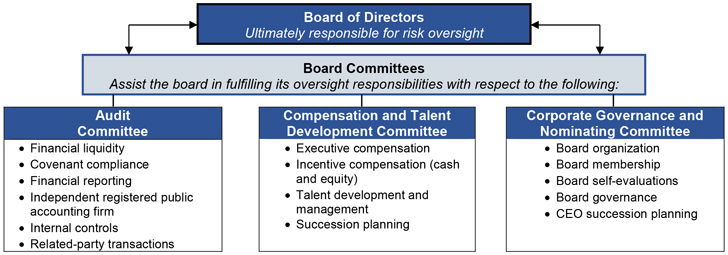

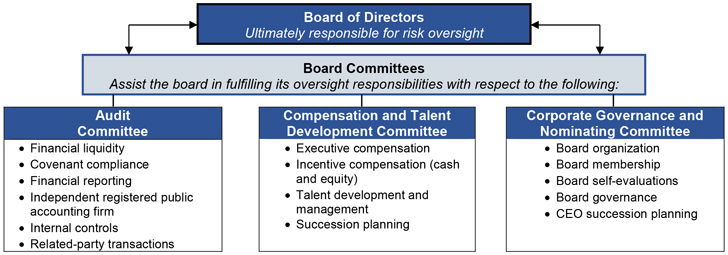

Board Committees To provide for effective direction and management of our business, our board has established three standing committees: an audit committee, a compensation and talent development committee (referred to as the “compensation committee” in most instances hereinafter) and a corporate governance and nominating committee.committee (referred to as the “governance/nominating committee” in most instances hereinafter). Each of the audit, compensation and corporate governance and governance/nominating committees are composed entirely of independent directors. Each committee operates under a written charter adopted by our board. All of the committee charters are available on our website atwww.strlco.com under Investor Relations–Corporate Governance and are available in print upon request. The following table identifies the current committee members.

| | | | | | | | | |

Name of Director*(1) | |

(2) | |

and Talent Development Committee | | Corporate Governance and Nominating Committee(2) | | | | | Marian M. Davenport | | — | | X | | Chair | Maarten D. Hemsley | | X | | — | | X | Raymond F. Messer | | X | | X | | — | Charles R. Patton | | — | | X | | — | Richard O. Schaum | | X✓ | | Chair | | —-- | | | | | Raymond F. Messer | | -- | | ✓ | | Chair | | | | | Dana C. O’Brien(3) | | ✓ | | -- | | ✓ | | | | | Charles R. Patton | | -- | | ✓ | | ✓ | | | | | Richard O. Schaum(4) | | ✓ | | ✓ | | -- | | | | | Milton L. Scott | | Chair | | —-- | | X✓ | | | | | Thomas M. White | | ✓ | | ✓ | | ✓ |

* As a non-independent director, Mr. Cutillo does not serve as a member of any committee of the board, all of which are composed entirely of independent directors.

| (1) | As anon-independent director, Mr. Cutillo does not serve as a member of any committee of the board, all of which are composed entirely of independent directors. | |

| (2) | Maarten D. Hemsley served as a member of the audit and governance/nominating committees during 2018 until his retirement on July 31, 2018. | |

| (3) | Dana C. O’Brien joined the audit and governance/nominating committees effective January 2019 in connection with her appointment to the board. | |

| (4) | Richard O. Schaum will retire as a director in conjunction with the annual meeting. | |

Audit Committee. CommitteeThe audit committee assists the board in fulfilling its oversight responsibilities related to (1) the effectiveness of the company’sCompany’s internal control over financial reporting; (2) the integrity of the company’sCompany’s financial statements; (3) the qualifications and independence of the company’sCompany’s independent registered public accounting firm; (4) the evaluation of the performance of the company’sCompany’s independent registered public accounting firm; and (5) the review and approval or ratification of any transaction that would require disclosure under Item 404(a) of RegulationS-K of the Securities Exchange Act of 1934 (the Exchange Act). Please refer to the “Audit Committee Report” included in this proxy statement for more information. The audit committee held sixfive meetings in 2017.

Compensation Committee. and Talent Development CommitteeThe compensation committee assists the board in fulfilling its oversight responsibilities by (1) discharging the board’s responsibilities relating to the compensation of our executive officers, andofficers; (2) administering our cash-based and equity-based incentive compensation plans.plans; and (3) overseeing the Company’s talent development strategy. Please refer to “Compensation and Talent Development Committee Procedures” included in this proxy statement for more information. The compensation committee held ten14 meetings in 2017.

Corporate Governance and Nominating Committee. CommitteeThe corporate governance and governance/nominating committee assists the board in fulfilling its oversight responsibilities by (1) identifying, considering and recommending to the board qualified candidates for directorship; (2) monitoring the composition of the board and its committees and making recommendations to the board on the membership of the committees; (3) maintaining our board governance guidelines and recommending to the board any desirable changes; (4) evaluating the effectiveness of the board and its committees; (5) with input from the chair of our compensation committee, determining Sterling Construction |2019 Proxy Statement |7 |

the compensation of our directors; and (6) addressing any related matters required by the federal securities laws or theThe NASDAQ Stock Market (NASDAQ)LLC (“NASDAQ”). The corporate governance and governance/nominating committee held sixfour meetings in 2017.

Special Committee. During 2017, the board of directors authorized a special committee of independent directors, comprised of Ms. DavenportCompensation and Messrs. Hemsley, Patton, Schaum and Scott, with the power and authority to oversee the company’s efforts to evaluate potential strategic alternatives, including the acquisition of Tealstone and related financing. As previously disclosed, on March 8, 2017, we entered into a stock purchase agreement with the sellers named therein to acquire 100% of the outstanding stock of Tealstone Residential Concrete, Inc. and Tealstone Commercial, Inc. (collectively, Tealstone) for cash, shares of our common stock and promissory notes. The company completed its acquisition of Tealstone on April 3, 2017. The special committee held two meetings in 2017.

Board and Committee Independence; Financial Experts

On the basis of information solicited from each director, and upon the advice and recommendation of the corporate governance and nominating committee, our board of directors has determined that Ms. Davenport and Messrs. Hemsley, Messer, Patton, Schaum and Scott each have no material relationship with the company and are independent as defined in the director independence standards of NASDAQ listing standards, as currently in effect. In making these determinations, our board, with assistance from the company’s legal counsel, evaluated responses to a questionnaire completed annually by each director

regarding relationships and possible conflicts of interest between each director, the company and management. In its review of director independence, our board and legal counsel considered all commercial, industrial, banking, consulting, legal, accounting, charitable, and familial relationships any director may have with the company or management.

Our board of directors has determined that each of the members of the audit, compensation and corporate governance and nominating committees has no material relationship with the company and satisfies the independence criteria (including the enhanced criteria with respect to members of the audit and compensation committees) set forth in the applicable NASDAQ listing standards and SEC rules. In addition, our board of directors has determined that each of Messrs. Hemsley and Scott qualifies as an “audit committee financial expert,” as such term is defined by the rules of the SEC.

CompensationTalent Development Committee Procedures

The compensation committee has the sole authority to set annual compensation amounts and annual incentive plan criteria for our executive officers, evaluate the performance of our executive officers, and make awards to our executive officers under our incentive plans and programs. The compensation committee also has authorityreviews, and when appropriate, recommends to approvethe board any proposed plan or arrangement, including employment agreements, providing for incentive, severance, retirement,change-in-control or other compensation to our executive officers. The compensation committee oversees our assessment of whether our compensation policies and practices are likely to expose the companyCompany to material risks. In exercising its authority and carrying out its responsibilities, the compensation committee meets to discuss the structure of executive compensation, proposed employment agreements, severance arrangements, salaries, cash and equity incentive awards, and the achievement and the setting of financial and individual performance goals on which executive incentive compensation is based, using information circulated in advance of the meeting by the chair of the compensation committee. The compensation committee may delegate any of its responsibilities to one or more members of the committee, except to the extent such delegation is prohibited by law, rules and regulations of the SEC or the listing standards of NASDAQ. When the compensation committee discusses an executive officer'sofficer’s compensation, he or she is not permitted to be present. The compensation committee engaged an independent executive compensation consultant to advise the compensation committee on matters related to executive compensation. Please refer to the section titled “Executive Officer Compensation—Compensation Discussion and Analysis” for more information related to the independent executive compensation consultant.

Compensation and Talent Development Committee Interlocks and Insider Participation During 2017,2018, Ms. Davenport and Messrs. Messer, Patton, Schaum and PattonWhite served as members of our compensation committee. None of the members of the compensation committee is or has been an executive officer of our company. None of our executive officers served as a director or a member of a compensation committee (or other committee serving an equivalent function) of any other entity, an executive officer of which served as one of our directors or as a member of our compensation committee during 2017.

Board Evaluation Process The corporate governance and governance/nominating committee is responsible for overseeing the annual performance evaluation of the board. Annually, each director completes an evaluation of the full board and each committee upon which the director serves, whichserves. This board evaluation process is intended to provide each director with an opportunity to evaluate performance for the purpose of improving board and committee processes and effectiveness. The detailed questionnaire seeks quantitative ratings and subjective comments in key areas of board practices, and asks each director to evaluate how well the board or the committee, as applicable, operates and to make suggestions for improvements. Replies are anonymous and are collected and summarized by the chair of the corporate governance and governance/nominating committee. The summary is then discussed by the independent directors in an executive session held for such purpose. In addition, the chair of the corporate governance and governance/nominating committee conductsone-on-one interviews with each director to solicit additional feedback on the overall operation of the board and its committees, as well as specific feedback on the effectiveness of individual directors. The board chair or the chair of the corporate governance and governance/nominating committee

discusses the individual feedback with each board member. Any areas of board or committee performance that are identified as needing improvement or change are considered by the corporate governance and governance/nominating committee, which then makes a recommendation to the board on the matter.

Board’s Role in Oversight of Risk Management Our board of directors as a whole is responsible for risk oversight, with reviews of certain areas being conducted by the relevant board committees that report to the full board. In its risk oversight role, our board focuses on understanding the nature of directors reviews, evaluatesour enterprise risks, including our operations and discusses with appropriate membersstrategic direction, as well as the adequacy of management whether theour risk management processes designedprocess and implemented byoverall risk management system. There are adequatea number of ways our board performs this function, including (i) receiving management updates on our business operations, financial results and strategy and discussing risks related to the business at each regular board meeting, (ii) receiving reports on all significant committee activities at each regular board meeting and (iii) evaluating the risks inherent in identifying, assessing, managing and mitigating material risks facing the company. significant transactions as applicable. |8 | Sterling Construction |2019 Proxy Statement

Throughout the year, the board of directors receives briefings and assessments of the company'sCompany’s risks as they relate to:

safety

crisis management

information technology

compensation

talent

| | | | | | | | | · safety | | · crisis management | | · cybersecurity/information technology | | | | | | | · compensation | | · strategic planning | | · succession planning | | | | | | | · talent development and management | | · enterprise risk assessment | | |

Our board believes that full and open communication between executive management and our board is essential to effective risk oversight. Our chairman meets regularly with executive management to discuss a variety of matters including business strategies, opportunities, key challenges and risks facing the company,Company, as well as enterprise risk assessment and risk mitigation strategies. Executive management attends all regularly scheduled board meetings where they make presentations to our board on various strategic matters involving our operations and are available to address any questions or concerns raised by our board on risk management or any other matters. Our board of directors oversees the strategic direction of the company,Company, and in doing so considers the potential rewards and risks of the company’sCompany’s business opportunities and challenges, and monitors the development and management of risks that impact our strategic goals.

The board’s involvement in the strategic planning process is a critical part of the assessment of the risks that impact our strategic goals and the management of those risks as they develop. The board holds annual strategic and succession planning sessions to discuss, among other things, the utilization and development of talent and management succession. In 2018, this process led to our hiring a chief talent officer, effective January 2019, to assist the board and the compensation committee in their oversight over the development and management of the Company’s key talent and senior management.Each standing committee of the board of directors assists the board in fulfilling its risk oversight responsibility with respect toresponsibility. The chart below provides an overview of the following: | | | | | | Audit Committee | | Compensation Committee | | Corporate Governance and Nominating Committee | •Financial liquidity

| | •Executive compensation

| | •Board organization

| •Covenant compliance

•Financial reporting

| | •Incentive compensation(cash and equity)

| | •Board membership

•Board self-evaluations

| •Independent registered public accounting firm

•Internal controls

| | | | •Board governance

| •Related-party transactions

| | | | |

allocation of risk oversight responsibilities among the board committees.

The audit committee assists our board in fulfilling its oversight responsibilities with respect to certain areas of risk. The audit committee is responsible for reviewing and discussing with management and our independent registered public accounting firm any guidelines and policies relating to risk assessment and risk management, and the measures management has taken to monitor, control and minimize the company’sCompany’s major financial risk exposures. The audit committee also discusses with our independent registered public accounting firm the results of their processes to assess risk in the context of its audit engagement. The audit committee also assists our board in fulfilling its oversight responsibilities by monitoring the effectiveness of the company’sCompany’s internal control over financial reporting and legal and regulatory compliance. Our independent registered public accounting firm meets regularly in executive session with the audit committee. The audit committee regularly reports on these matters to the full board. Finally, in furtherance of its risk oversight responsibility, the audit committee provides for the confidential, anonymous submission by employees and others of concerns regarding questionable accounting, auditing and any other matters. These submissions are collected by an independent organization specializing in those services, and are conveyed to the chair of the audit committee, our chief compliance officer, and our general counsel.

The compensation committee assists our board in fulfilling its oversight responsibilities with respect to the company’sCompany’s assessment of whether its compensation policies and practices are likely to expose the companyCompany to material risks, including the company’sCompany’s compensation of executives and incentive compensation awarded to officers. Also,In addition, in consultation with management, the compensation committee is responsible for overseeing the company’sCompany’s compliance with regulations governing executive compensation.

The corporate governancecompensation committee also oversees the management and Sterling Construction |2019 Proxy Statement |9 |

development of the Company’s talent and the succession plan for key senior management positions, which we consider a critical asset of the Company. In 2018, we hired a chief talent officer, effective January 2019, who reports directly to the Company’s chief executive officer, and assists the compensation committee with managing and developing the Company’s talent. The chief talent officer will provide valuable assistance to the compensation committee and the board in its oversight of our strategy to recruit, train and retain a world-class workforce. The governance/nominating committee assists our board in fulfilling its oversight responsibilities with respect to the management of risks associated with our board leadership structure, including committee appointments, size of board and nomination of board members, and corporate governance matters. The corporate governance and governance/nominating committee addresses some of its risk oversight responsibilities by identifying and recommending for nomination well-qualified independent directors, periodically reviewing of our board governance guidelines, and conducting annual board self-evaluations and individual director evaluations (through the chair of the committee).

In addition, the governance/nominating committee reviews and discusses with management and the board the CEO succession plan. The governance/nominating committee, in consultation with management and the board periodically reviews and updates its CEO succession plan. Furthermore, the committee is responsible for developing and maintaining procedures to address emergency CEO succession planning in extraordinary circumstances, which mitigates the disruption and loss of continuity to our business and operations during a transition period.

Director and Executive Officer Stock Ownership Guidelines In January 2018, our board of directors revised the stock ownership guidelines applicable to ournon-employee directors and our executive officers. The board of directors believes that it is in the best interests of the companyCompany and its stockholders that directors and executive officers have a meaningful proprietary stake in the companyCompany so that their interests are aligned with the interests of stockholders. The stock ownership guidelines are administered by the corporate governance and governance/nominating committee. Under our stock ownership guidelines, (i) eachnon-employee director is expected to acquire and maintain ownership of our common stock valued at five times his or her annual cash retainer, which is currently $50,000,$75,000, (ii) our chief executive officer is expected to acquire and maintain ownership of our common stock valued at five times his or her base salary, and (iii) each of our other executive officers is expected to acquire and maintain ownership of our common stock valued at three times his or her base salary. The value of the shares is based on the greater of the then current market price or the grant date fair value. Shares of our common stock owned individually or jointly, shares held by members of the director or executive’s immediate family or by a trust for the director or executive or his or her immediate family, as well as shares subject to unvested restricted stock and restricted stock units are counted for purposes of the stock ownership guidelines. As of March 13, 2018,19, 2019, all of our currentnon-employee directors except Mr.Ms. O’Brien and Messrs. Messer and White exceeded their target ownership levels. Under the stock ownership guidelines, directors have five years from the date of appointment or election to comply with the stock ownership guidelines. Mr. Messer who was first elected to the board at the 2017 annual meeting, Mr. White was first appointed to the board in July 2018 and Ms. O’Brien was first appointed to the board effective January 2019. Since each of Ms. O’Brien and Messrs. Messer and White is required to reach histheir stock ownership target within five years from the date of election, and, thus,each of these directors is currently in compliance with the guidelines. Our executive officers have five years from the date of their respective appointments (oror from January 17, 2018, the date upon which the guidelines were revised, whichever is later)later, to attain their required ownership levels. AllSince all of our executive officers have all been in their respective positions with the companyCompany for less than threefive years, so each has until January 17, 2023 to reach his target ownership level and, thus, each of our executive officers is currently in compliance with the guidelines. For more information regarding the stock ownership guidelines applicable to our executive officers, see “Compensation Discussion and Analysis.”

Consideration of Director Nominees In evaluating nominees for membership on our board of directors, the corporate governance and governance/nominating committee has not specified any minimum qualifications for serving on the board, but seeks to achieve a board that is composed of individuals who have experience that is relevant to the needs of the company,Company, who have a high level of professional and personal integrity, who have the ability and willingness to work cooperatively with other members of our board and with senior management, and who contribute to the cognitive diversity of the board taking into account many factors, including business experience, public sector experience, professional training, public and private offices held, geographical representation, race, gender and age, among other considerations. Experience in the construction industry and in one or more of engineering, transportation, finance and accounting, corporate governance, senior management, and public sector matters are considered particularly valuable. An independent director candidate is expected to be committed to |10 | Sterling Construction |2019 Proxy Statement

enhancing stockholder value, and to have sufficient time to carry out the duties of a director,

both on the full board and on one or more of its standing committees. In selecting nominees, the corporate governance and governance/nominating committee will seek to have a board of directors that represents a diverse range of perspectives and experience relevant to the company.Company. The corporate governance and governance/nominating committee will also evaluate each individual in the context of our board as a whole, with the objective of recommending nominees who can best perpetuate the success of the business, be an effective director in conjunction with the full board, and represent stockholder interests through the exercise of sound judgment using his or her diversity of experience in these various areas. In determining whether to recommend a director forre-election, the corporate governance and governance/nominating committee will also consider the director’s age, tenure, past attendance at meetings and participation in and contributions to the activities of our board. The corporate governance and governance/nominating committee will regularly assess whether the size of our board is appropriate, and whether any vacancies on our board are expected due to retirement or otherwise. In addition, the corporate governance and governance/nominating committee periodically assesses the experience, qualifications, attributes and skills of the independent directors to determine if there are gaps that the board should seek to fill. In the event that vacancies are anticipated, or otherwise arise, the corporate governance and governance/nominating committee will consider various potential candidates, who may come to the corporate governance and governance/nominating committee’s attention through professional search firms, stockholders or other persons. Alternatively, the corporate governance and governance/nominating committee may recommend a reduction in the size of the board. Each candidate brought to the attention of the corporate governance and governance/nominating committee, regardless of who recommended such candidate, will be considered on the basis of the criteria set forth above.

The corporate governance and In accordance with its charter, the governance/nominating committee will consider candidates proposed for nomination by our stockholders. Stockholders may propose candidates for consideration by the corporate governance and governance/nominating committee by submitting the names and supporting information to: c/c⁄o Corporate Secretary, Sterling Construction Company, Inc., 1800 Hughes Landing Blvd. — Suite 250, The Woodlands, Texas 77380.

In addition, our bylaws permit stockholders to nominate candidates for consideration at next year’s annual stockholder meeting. Any nomination must be in writing and received by our corporate secretary at our principal executive offices no later than February 1, 2019.8, 2020. If the date of next year’s annual meeting is moved to a date more than 30 days before or 90 days after the anniversary of this year’s annual meeting, the nomination must be received no later than 90 days prior to the date of the 20192020 annual meeting or 10 days following the public announcement of the date of the 20192020 annual meeting. Any stockholder submitting a nomination under our bylaws must comply with the requirement provided in the bylaws including providing: (a) all information relating to the nominee that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (including such nominee’s written consent to being named in the proxy statement as a nominee and to serve as a director if elected); and (b) the name and address (as they appear on the company’sCompany’s books) of the nominating stockholder and the class and number of shares beneficially owned by such stockholder.

Communications with the Board Stockholders or other interested parties may communicate directly with one or more members of our board, or thenon-employee directors as a group, by writing to the director or directors at the following address: c/c⁄o Corporate Secretary, Sterling Construction Company, Inc., 1800 Hughes Landing Blvd. — Suite 250, The Woodlands, Texas 77380; or bye-mail to the corporate secretary at: Reports@Lighthouse-Services.com. Each communication should specify the addressee as well as the general topic of the communication. The communication will be forwarded to the appropriate director or directors, unless it is frivolous. If the communication is voluminous, the corporate secretary will summarize it and furnish a summary to the appropriate director or directors. Sterling Construction |2019 Proxy Statement |11 |

Director Compensation In setting director compensation, we consider the significant amount of time directors dedicate in fulfilling their duties as directors, as well as the skill-level required to be an effective member of our board. We also seek to align the directors’ compensation with our stockholders’ interest by delivering a substantial portion of that compensation in the form of equity-based compensation. The corporate governance and governance/nominating committee reviews the form and amount of director compensation and, with the advice of the chair of the compensation committee, makes recommendations to the full board. We use a combination of cash and equity-based incentive compensation to compensate ournon-employee directors, as described below.

In early 2018, the governance/nominating committee engaged Meridian Compensation Partners, LLC (“Meridian”), the board’s independent compensation consultant, to conduct a competitive analysis ofnon-employee director compensation and evaluate our program in light of the results of its analysis. Meridian analyzed thenon-employee director compensation programs of three comparator groups: the Company’s full peer group used to evaluate executive officer compensation (see page 24 for a list of those companies), a subset of the full peer group comprised of peers with revenues below $3 billion, and a general industry survey data for companies with revenues between $500 million and $1 billion. Meridian’s findings indicated that our per director average compensation was below the 25th percentile of the full peer group and approximated the 25th percentile of the general industry survey, noting that the largest discrepancy was the level of equity-based compensation. Following the governance/nominating committee’s review of the report and discussions with Meridian, the committee recommended and the board approved the following changes to our program effective May 1, 2018: a $25,000 increase in the annual board retainer and the elimination of all meeting fees, and a $35,000 increase in the annual target equity award.

Cash Compensation Effective May 1, 2017,2018, eachnon-employee director receives an annual fee paid monthly consisting of, as applicable: $50,000 for serving on our board (including the chairman of the board of directors), increased from $30,000;

$25,000 for serving as chair of the audit committee (including if performed by the chairman of the board of directors);

$15,000 for serving as chair of the compensation committee (unless performed by the chairman of the board of directors);

$10,000 for serving as chair of the corporate governance and nominating committee (unless performed by the chairman of the board of directors); and

$100,000 for serving as chairman of the board of directors.

| · | | $75,000 for serving on our board (including the chairman of the board of directors), increased from $50,000; |

| · | | $25,000 for serving as chair of the audit committee (including if performed by the chairman of the board of directors); |

| · | | $15,000 for serving as chair of the compensation committee (unless performed by the chairman of the board of directors); |

| · | | $10,000 for serving as chair of the governance/nominating committee (unless performed by the chairman of the board of directors); and |

| · | | $100,000 for serving as chairman of the board of directors. |

Also, each director receives reimbursement for reasonable out of pocket expenses incurred in attending board and committee meetings, as well as investor conferences and education programs attended at the request of the company. In additionCompany. Effective May 1, 2018, we no longer pay meeting fees to the annual director fees, each non-employee-director (other than the chairman) receives a fee of $1,500 for attending each board meeting in person, and a fee for attending any committee meeting (of which he or she is a member) in person:

$1,000 per audit committee meeting (in connection with a board meeting) or $1,500 per audit committee meeting (not in connection with a board meeting); and

$500 per compensation or corporate governance and nominating committee meeting (in connection with a board meeting) or $750 per compensation or corporate governance and nominating committee meeting (not in connection with a board meeting).

For participation at a board or committee meeting by telephone, each non-employee director (other than the chairman) instead receives $500 (if less than an hour) or $750 (if over an hour) per meeting attended by telephone. In connection with their service on the special committee of the board in 2017, Ms. Davenport and each of Messrs. Hemsley, Patton, Schaum and Scott received additional fees in the amount of $1,500.

Equity-Based Compensation Eachnon-employee director also receives equity-based compensation under our stockholder-approved stock incentive plan consisting of annual grants of restricted stock. Each year on the day of the annual meeting of stockholders, eachnon-employee director is awarded shares of restricted stock with an aggregate grant date value of $50,000.$85,000. The restricted stock vests the day prior to the following year’s annual meeting of stockholders, with potential accelerated vesting in the event that thenon-employee director dies or becomes

permanently disabled, or in the event there is a qualifying change of control of the company. TheCompany. Unless otherwise determined by the Board, the restricted stock is forfeited if prior to vesting, the director ceases to be a director for any other reason. 20172018 Director Compensation

The table below summarizes the total compensation paid to or earned by ournon-employee directors during 2017.2018. The amount included in the “Stock Awards” column reflects the aggregate grant date fair value of the restricted stock, and does not necessarily reflect the income that will ultimately be realized by the director for these stock awards. Mr. Cutillo did not receive any compensation for his service on our board of directors, and Mr. Varello did not begin receiving compensation for service on our board of directors until April 28, 2017, when he ceased serving as an officer of the company.directors. The compensation paid to Messrs. Mr. |12 | Sterling Construction |2019 Proxy Statement

Cutillo and Varello, including compensation received in Mr. Varello’s capacity as a director, during 20172018 is reflected in the "2017“2018 Summary Compensation"Compensation” table on page 29. | | | | | | | | | Name of Director | | Fees Earned or Paid in Cash | | Stock Awards (1) | | Total | | Marian M. Davenport | | $72,083 | | $49,994 | | $122,077 | | Maarten D. Hemsley | | $70,167 | | $49,994 | | $120,161 | Raymond F. Messer (2) | | $43,833 | | $49,994 | | $93,827 | | Charles R. Patton | | $56,583 | | $49,994 | | $106,577 | | Richard O. Schaum | | $79,083 | | $49,994 | | $129,077 | | Milton L. Scott | | $168,333 | | $49,994 | | $218,327 |

_____________________

30. | | | | | | | | | | | | | | | | | Name of Director | | Fees Earned or Paid in

Cash | | Stock Awards(1) | | Total | Marian M. Davenport | | | $ | 86,750 | | | | $ | 84,998 | | | | $ | 171,748 | | Maarten D. Hemsley(2) | | | | 49,833 | | | | | 84,998 | | | | | 134,831 | | Raymond F. Messer | | | | 78,417 | | | | | 84,998 | | | | | 163,415 | | Dana C. O’Brien(3) | | | | n/a | | | | | n/a | | | | | n/a | | Charles R. Patton | | | | 71,583 | | | | | 84,998 | | | | | 156,581 | | Richard O. Schaum(4) | | | | 81,083 | | | | | 84,998 | | | | | 166,081 | | Milton L. Scott | | | | 189,583 | | | | | 84,998 | | | | | 274,581 | | Thomas M. White(5) | | | | 25,000 | | | | | 65,350 | | | | | 90,350 | |

| | (1) | Amounts reflect the aggregate grant date fair value of the restricted stock, which is valued on the date of grant at the closing sale price per share of our common stock in accordance with Financial Accounting Standards Board Accounting Standards Codification (ASC) Topic 718, disregarding the effect of forfeitures. On April 28, 2017,May 2, 2018, the Board approved the award to eachnon-employee director of restricted shares valued at $85,000 based on the closing price of our common stock on May 2, 2018, the date of the annual meeting. The awards were not effective until May 8, 2018, following the effectiveness of our FormS-8 registering the shares issuable under our new stock incentive plan. Eachnon-employee director was granted 5,2577,404 shares of restricted stock, which had a grant date fair value of $9.51$11.48 per share. As of December 31, 2017,2018, eachnon-employee director, except Mr. White, had 5,2577,404 shares of restricted stock outstanding. On July 31, 2018, in connection with his appointment to the board, Mr. White was granted 4,866 shares of restricted stock, which had a grant date fair value of $13.43 per share. As of December 31, 2018, Mr. White had 4,866 shares of restricted stock outstanding. | |

| (2) | Maarten D. Hemsley retired from the board effective July 31, 2018. | |

(2)

| Mr. Messer(3) | Dana C. O’Brien joined our board effective January 1, 2019, thus she did not receive any compensation for 2018. | |

| (4) | Richard O. Schaum will retire as a director in conjunction with the annual meeting. | |

| (5) | Thomas M. White was first elected as a director atof the 2017 annual meeting, and was appointed to the audit and compensation committeesCompany on April 28, 2017.July 31, 2018. | |

Sterling Construction |2019 Proxy Statement |13 |

_____________________

Proposal No. 1: Election of Directors In accordance with our bylaws, effective as of the annual meeting, our board of directors has fixed the current number of directors at seven.eight. Upon recommendation of our corporate governancegovernance/nominating committee, and nominating committee,in furtherance of our board refreshment efforts, our board of directors has nominated Roger A. Cregg, Joseph A. Cutillo, Marian M. Davenport, Maarten D. Hemsley, Raymond F. Messer, Dana C. O’Brien, Charles R. Patton, Richard O. Schaum and Milton L. Scott and Thomas M. White to serve as our directors, each until the next annual meeting and election of their successor. All of the nominees are current directors.directors, except for Mr. Cregg. Each nominee has consented to being named as a nominee in this proxy statement and to serve as a director if elected. The persons named as proxies intend to vote your shares of our common stock for the election of each of the director nominees, unless otherwise directed. If, contrary to our present expectations, any of the nominees is unable to serve, the proxy holders may vote for a substitute nominee. The board has no reason to believe that any of the nominees will be unable to serve. Our board and the corporate governance and nominating committee are considering the expansion of our board and are in the process of identifying qualified candidates with highly additive skills and relevant experience to maximize the Board’s effectiveness. We believe that nominating a director to serve the company is a significant undertaking that requires a thoughtful and diligent process, both in the identification of a pool of potential candidates and in determining which specific candidate will best serve the company. Although this process was not completed in time to nominate a new director at the annual meeting, we hope to select a candidate soon, and will follow the election procedures set forth in our bylaws. In selecting a nominee to serve as a member of our board, the corporate governance and nominating committee will adhere to the principles outlined in our board governance guidelines and will be mindful of the Board’s desire to increase Board diversity. See “Consideration of Director Nominees” for more information.

Vote Required to Elect Director Nominees Under our bylaws, in an uncontested election, our directors are elected by a majority of the votes cast.cast, with the directors receiving more for than against votes being elected. In contested elections where the number of nominees exceeds the number of directors to be elected, directors are elected by a plurality vote, with the director nominees who receive the most votes being elected. As a condition to nomination for election or reelection to the Board,board in an uncontested election, each incumbent director or director nominee submits to the board in advance of the annual meeting an executed irrevocable letter of resignation that is deemed tendered if the director fails to receive the votes required for election or reelection. Such resignation shall only be effective upon acceptance by the board of directors, which effective time may be deferred until a replacement director is identified and appointed to the board. If an incumbent director fails to achieve a majority of the votes cast in an uncontested election, the corporate governance and governance/nominating committee will make a recommendation to the board of directors on whether to accept or reject the resignation, or whether other action should be taken. The board of directors will act promptly on the corporate governance and governance/nominating committee'scommittee’s recommendation, considering all factors that the Boardboard of Directorsdirectors believes to be relevant, and will publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of the election results. For more information on the voting requirements, see “Questions and Answers about the Proxy Materials, Annual Meeting and Voting.” Recommendation of ourthe Board of Directors | | | ✔ | | OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTEFOR EACH OF THE EIGHT DIRECTOR NOMINEES LISTED BELOW. |

|14 | Sterling Construction |2019 Proxy Statement

OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR

EACH OF THE SEVEN DIRECTOR NOMINEES.

Information about Director Nominees and Continuing Directors The table below provides certain information as of March 13, 2018,19, 2019, with respect to the director nominees. The biography of each of the directorsdirector nominees contains information regarding the person’s business experience, director positions with other public companies held currently or at any time during the last five years, and the experiences, qualifications, attributes and skills that caused our board to determine that the person should be nominated to serve as a director of the company.Company. Unless otherwise indicated, each person has been engaged in the principal occupation shown for the past five years.

The table below shows certain information about the nominees.

| | | | | | | | | Name of Director | | Age | | Principal Occupation, Business Experience and Other Public Company Directorships | | Director Since | | | | | | | | | | Joseph A. Cutillo | | 52 | | Mr. Cutillo has served as the Chief Executive Officer of the company since 2017. He joined the company in October 2015 as Vice President, Strategy & Business Development. In May 2016, he was promoted to Executive Vice President and Chief Business Development Officer. In February 2017, he was promoted to President of the company and in April 2017 he was promoted to Chief Executive Officer. Prior to joining the company, Mr. Cutillo was President and Chief Executive Officer of Inland Pipe Rehabilitation LLC, a $200 million private equity-backed trenchless pipe rehabilitation company, from August 2008 to October 2015.

Experience, Qualifications, Attributes & Skills. Mr. Cutillo brings to the board his thirty years of managerial experience and a deep understanding of emerging opportunities in heavy civil construction, industrial, and water infrastructure markets. In addition, Mr. Cutillo’s knowledge and understanding of the Company’s operational strategy and organizational structure, together with his operational and leadership experience at various levels of management contribute to the breadth and depth of the board’s deliberations. Mr. Cutillo holds a Bachelor of Science in Mechanical Engineering from Northeastern University. | | 2017 | | | | | | | | Chief Executive Officer of Sterling Construction Company, Inc. | | | | | | | | | | | | | | Marian M. Davenport (Independent) | | 64 | | Ms. Davenport has served on the Board of Directors and as Executive Director of Genesys Works - Houston, a nationally-recognized nonprofit organization that trains and employs high school seniors from underserved communities to work as professionals in major corporations, since April 2013. Ms. Davenport was associated with Big Brothers Big Sisters, a non-profit organization that provides one-to-one mentoring for children from September 2004 to April 2013. During this period, she held various positions in its affiliated organizations, including serving as President & Chief Executive Officer of Big Brothers Big Sisters of Greater Houston from September 2004 to June 2010, and Senior Vice President, Operations and Capacity Building of Big Brothers Big Sisters Lone Star from June 2010 to March 2013. Ms. Davenport was employed by Dynegy Inc., a publicly-traded company in the business of power distribution, marketing and trading of gas, power and other commodities, midstream services and electric distribution from April 1997 to December 2013. She joined Dynegy as General Counsel, Commercial Development and rose to the position of Senior Vice President, Legislative and Regulatory Affairs.

| | 2014 | | | | | | | Executive Director, Genesys Works - Houston

| | | | | |

| | | | | | | | | Name of Director | | Age | | Principal Occupation, Business Experience and Other Public Company Directorships | | Director Since | Ms. Davenport (cont.) Committees: Corporate Governance and Nominating (Chair) Compensation | | | | Experience, Qualifications, Attributes & Skills. Ms. Davenport brings to the board her background as a lawyer, with experience in corporate governance and securities compliance, having served as general counsel of a public company. Ms. Davenport gained extensive leadership and managerial experience as an executive in the energy industry while employed with Dynegy, where she managed the development of large natural gas-fired power plants and played a pivotal role in improving the performance of critical company functions, including human resources. Ms. Davenport's more recent career in the non-profit sector providing mentoring and workforce development opportunities for disadvantaged youth brings a new perspective and expertise to the Company, which operates in an industry where finding competent candidates for employment at all levels is more and more competitive. In sum, Ms. Davenport's extensive background in both the for-profit and non-profit sectors brings cognitive diversity to the board and the committees on which she serves. Ms. Davenport holds a Bachelor of Arts degree, Liberal Arts and Sciences, from The Colorado College, of Colorado Springs, Colorado, and a Juris Doctorate from the University of Denver, College of Law, in Denver, Colorado. Ms. Davenport is a member of the Texas State Bar. | | | | | | | | | | | Maarten D. Hemsley (Independent)

| | 68 | | Mr. Hemsley founded New England Center for Arts & Technology, Inc. (NECAT), a career-directed educational non-profit serving resource-limited adults in Boston, Massachusetts, in 2010 and currently serves as its Chairman and President. Prior to founding NECAT, he served as the Company's President and Chief Operating Officer from 1988 until 2001, and its Chief Financial Officer from 1998 until 2007. From 2001 until retiring in March 2012, Mr. Hemsley was engaged by Harwood Capital LLP (Harwood) (formerly JO Hambro Capital Management Limited), an investment management company based in the United Kingdom. During that period, Mr. Hemsley served as a Fund Manager, Senior Fund Manager and Senior Advisor to several investment funds managed by Harwood. Other Directorships. From 2003 until February 2016, Mr. Hemsley was a director of Sevcon, Inc., a public company (during his term) that manufactures electronic controls for electric vehicles and other equipment. He has also served on the boards of a number of privately-held companies in the United Kingdom. Experience, Qualifications, Attributes & Skills. Mr. Hemsley has extensive financial experience and managerial skills gained over many years managing investment funds, serving the Company, including nine years as Chief Financial Officer and thirteen years as President, and serving as the chief financial officer of several medium-sized public and private companies in a variety of business sectors in the U.S. and Europe. His knowledge of the Company, derived from more than twenty-five years of service, as well as his analytical skills honed as a fund manager responsible for making investment decisions and overseeing the management of a wide range of portfolio companies, enable him to contribute to the board's oversight of the Company's business, its financial risks, its executive compensation arrangements, the risks inherent in its acquisition program and in post-acquisition integration issues. Mr. Hemsley is a Fellow of the Institute of Chartered Accountants in England and Wales.

| | 1998 | | | | | | | Founder, Chairman and President of New England Center for Arts & Technology, Inc.

Committees: Audit Corporate Governance and Nominating

| | | | | |

| | | | | | | | | Name of Director | | Age | | Principal Occupation, Business Experience and Other Public Company Directorships | | Director Since | | | | | | | | | Raymond F. Messer (Independent)

| | 70 | | Mr. Messer is Chairman Emeritus of Walter P Moore, a private international company that provides structural, diagnostic, civil, traffic, parking, transportation, water resources and Intelligent Transportation Systems (ITS) engineering services. Mr. Messer served as the Director of Design-Build and Senior Principal of from January 2015 until his retirement in June 2017. Mr. Messer served as President and Chief Executive Officer of Walter P Moore from July 1993 until January 2015, when he implemented the company’s leadership transition plan and assumed the position of Director of Design-Build, both to remain available for consultation with his successor and to establish a better presence for the firm in the design-build construction market. Mr. Messer joined Walter P. Moore in November 1981 as the Director of Pre-stressed Concrete Design. In February 1984, he was named the Manager of Walter P Moore’s Tampa, Florida office, and held that position until assuming the role of President and Chief Executive Officer. Mr. Messer served on Walter P Moore's board of directors from April 1986, until April 2015, and served as chairman of the board from June 1998 to April 2015 Prior to joining Walter P Moore, Mr. Messer served in various roles of increasing responsibility at Exxon Research and Engineering, HNTB Corporation, Bechtel Corporation, and VSL International Ltd.

Other Directorships. Mr. Messer serves on the board of Kennedy/Jenks Consultants, a private environmental and water resources engineering company, where he chairs the nominating and compensation committees. He also serves on the board of Braun Intertec, a private materials testing and geotechnical engineering firm, where he serves on the compensation/human resources and nominating committees. He serves on the boards of not-for-profits Texas Higher Education Foundation, Stages Theatre, Genesys Works. He has also served on the national executive committee of the American Council of Engineering Companies.

Experience, Qualifications, Attributes & Skills. In addition to his engineering degrees, Mr. Messer brings to the board over 40 years of practical experience in engineering design, project management and construction, all matters that relate directly to the Company's construction businesses. During his tenure as President and Chief Executive Officer of Walter P. Moore, he acquired leadership, managerial and corporate governance skills that contribute to the board’s industry-specific expertise and ability to fulfill its responsibilities. In addition, the variety of his private and not-for-profit board experience enables him to bring to the Company valuable strategic insights into board matters generally. Mr. Messer is a Licensed Professional Engineer in Texas, Florida and New York. He holds a Bachelor of Arts in Mathematics from Carroll College, Helena Montana and a Bachelor of Science in Civil Engineering and a Master of Science in Engineering Mechanics from Columbia University.

| | 2017 | | | | | | | Chairman Emeritus, Walter P Moore

Committees: Audit Compensation

| | | | | |

| | | | | | | | | Name of Director | | Age | | Principal Occupation, Business Experience and Other Public Company Directorships | | Director Since | | | | | | | | | Charles R. Patton (Independent)